A roundup of recent and forthcoming climate disclosure policy affecting food & beverage companies (2023)

Climate disclosure policy seeks to standardize the what, when, and how of companies’ climate disclosures

By: Lydia Ashburn

December 7, 2023

December 7, 2023

Edit: This article describes the state of climate policy as of the date of release. We will release similar roundups in future years, which will reflect any changes and updates to the policies below.

Across the world, policy is arising around climate-related corporate disclosures. These policies seek to standardize the what, when, and how around climate reporting so that investors, consumers, and other stakeholders can make informed investment and purchasing decisions.

This article outlines what exactly climate disclosure is, why it’s being regulated, and what the major policies are relevant to food & beverage companies.

(Click here to jump straight down to the table outlining climate disclosure policies.)

Across the world, policy is arising around climate-related corporate disclosures. These policies seek to standardize the what, when, and how around climate reporting so that investors, consumers, and other stakeholders can make informed investment and purchasing decisions.

This article outlines what exactly climate disclosure is, why it’s being regulated, and what the major policies are relevant to food & beverage companies.

(Click here to jump straight down to the table outlining climate disclosure policies.)

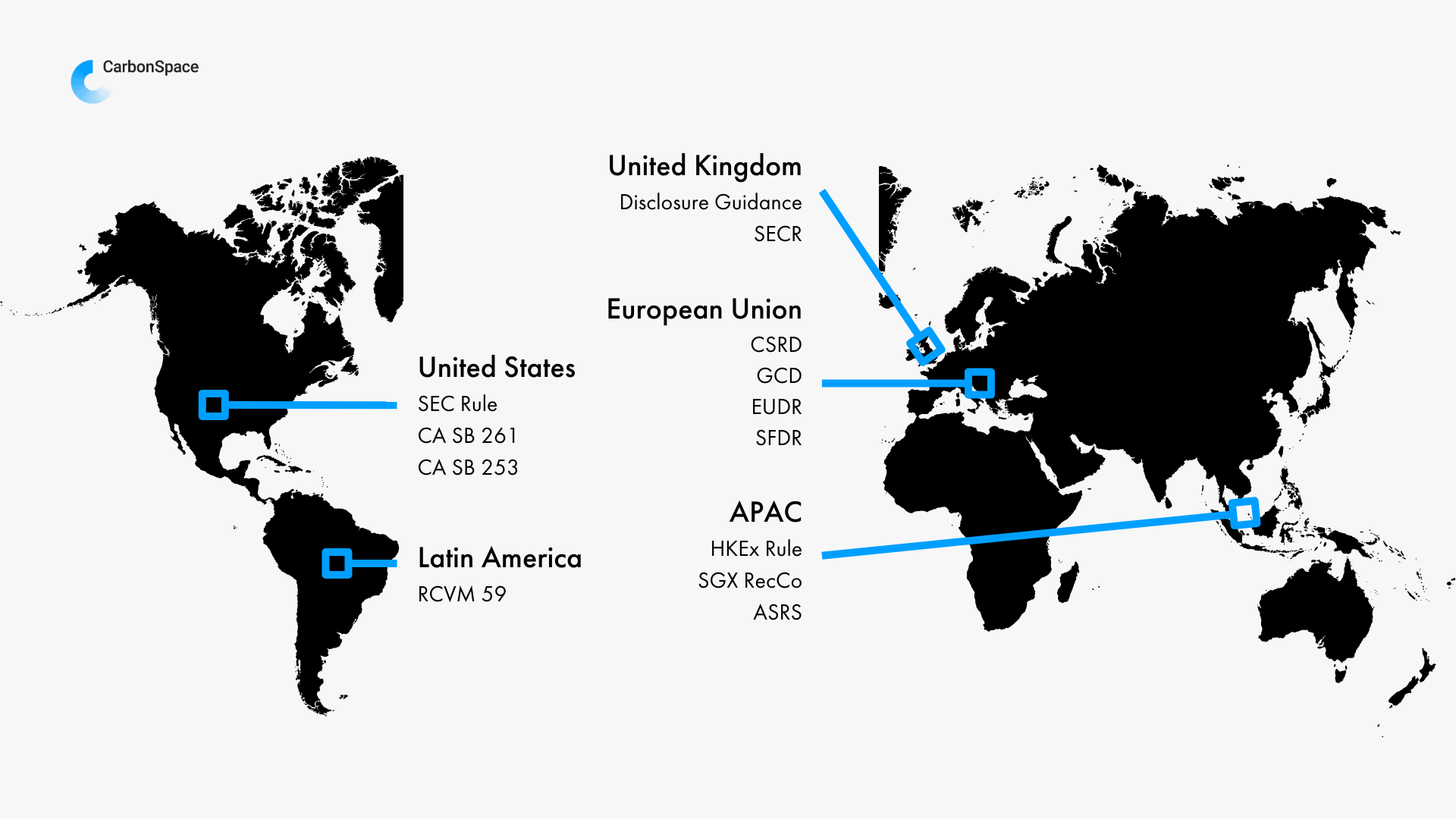

Figure 1. Map of global climate-related disclosure policies.

What is climate disclosure?

Climate disclosure refers to the data companies report regarding the impact of their business practices on the environment (impact materiality) and the impact of the environment, namely climate change risk, on their business (financial materiality).

Another term you’ll hear for these types of disclosure is ESG (environmental, social, and governance) reporting.

Another term you’ll hear for these types of disclosure is ESG (environmental, social, and governance) reporting.

Impact materiality disclosure

The European Sustainability Regulation Standard (ESRS) defines impact materiality as “material actual or potential, positive or negative impacts on people or the environment over the short-, medium- or long term.” 1

You can think of impact materiality as an “inside out” perspective, addressing questions of how the company is affecting the environment and people through its operations.

This perspective is of interest to a broad range of stakeholders, from consumers to employees to investors.

You can think of impact materiality as an “inside out” perspective, addressing questions of how the company is affecting the environment and people through its operations.

This perspective is of interest to a broad range of stakeholders, from consumers to employees to investors.

Financial materiality disclosure

“A sustainability matter is material from a financial perspective if it triggers or may trigger material financial effects on the undertaking’s development, including cash flows, financial position and financial performance, in the short-, medium- or long-term.”1

Financial materiality takes an “outside in” perspective, addressing questions of how issues such as climate change will affect the company and how ready the company is for those changes.

This perspective is of particular interest to investors evaluating long term viability of a company.

Financial materiality takes an “outside in” perspective, addressing questions of how issues such as climate change will affect the company and how ready the company is for those changes.

This perspective is of particular interest to investors evaluating long term viability of a company.

Double materiality

Double materiality refers to reporting on both of these perspectives.

The policy requirements outlined below range across financial, impact, and double materiality.

The policy requirements outlined below range across financial, impact, and double materiality.

Why are climate disclosures being regulated?

Policy around impact materiality disclosure has come about due to increasing calls from consumers and the workforce to understand a company’s environmental and social impact and what measures they’re taking to manage and improve that impact. When reporting is not required, absence of reporting can lead to skepticism.

Policy around financial materiality disclosure is rapidly increasing due to the understanding that climate change poses risks to companies’ operations, especially those relying on natural resources. Investors are particularly keen on understanding the level of this risk, how companies are managing it, and what level of resilience companies will be able to maintain.

Policy around financial materiality disclosure is rapidly increasing due to the understanding that climate change poses risks to companies’ operations, especially those relying on natural resources. Investors are particularly keen on understanding the level of this risk, how companies are managing it, and what level of resilience companies will be able to maintain.

Climate-Related Policy Overview Table

The table below provides an overview of major climate disclosure policies that are relevant to the food & beverage industry along with a categorization of materiality.

A few notes about the table’s categories and information:

- The table contains a combination of policy types, including both government legislation and market-specific rules and directives. For more information, such as specifics on affected companies or penalties for non-compliance, check out the links to each policy.

- This list is not exhaustive but rather contains the major policy at the time of release.

- The materiality categorization gives as idea of the focus of the policy. There are certainly gray areas, so the categorization is not meant to be perfect but rather provide a general sense of the policy’s aim.

What do these climate disclosure policies mean for food & beverage companies?

Reporting on supply chain climate impact will be cumbersome but necessary

- Scope 3 reporting is the most difficult to achieve for any industry because it refers to activities outside of a company’s direct control. Up to 95% of food & beverage companies' emissions may be Scope 3, meaning a majority of reporting will be complex.

- Even for policy pertaining only to public companies, private companies in public companies’ supply chains will be subject to reporting under certain rules. Working with suppliers who otherwise won’t need to report on emissions will require capacity building.

- Double materiality is particularly relevant for food & beverage companies because their agricultural supply chains can have both a positive and negative impact on the environment, depending on practices. And conversely, the state of the environment and climate directly impacts the productivity of farms and the security of agricultural supply. Reporting on this double materiality for food & beverage companies is critical due to the many nuances of agriculture and sourcing.

Get climate reporting tools and systems in place now

As some policies are already in effect and others’ initial report deadlines are approaching, it’s time to get data collection and monitoring systems in place, especially for Scope 3 emissions.

With the food & beverage industry having 1) majority supply chain emissions, 2) climate-dependent ingredient supplies, and 3) the ability to affect the ecosystem both positively and negatively through business activities, companies have much to capture and communicate through reporting.

Tools exist and are emerging to ease this reporting process. Automated tools that require minimal input from suppliers will be crucial, especially for land-use reporting. Tools that can stand up to scrutiny under checks on accuracy are also essential.

With the food & beverage industry having 1) majority supply chain emissions, 2) climate-dependent ingredient supplies, and 3) the ability to affect the ecosystem both positively and negatively through business activities, companies have much to capture and communicate through reporting.

Tools exist and are emerging to ease this reporting process. Automated tools that require minimal input from suppliers will be crucial, especially for land-use reporting. Tools that can stand up to scrutiny under checks on accuracy are also essential.

As policy continues to emerge, CarbonSpace is here to provide an automated, third-party validated, and comprehensive tool for reporting on supply chain carbon emissions and sequestration for agricultural commodities across the globe. We’re closely following disclosure policy to ensure our tool supports food & beverage companies’ needs.

A note: Additional Climate-Impact Reporting Frameworks

Frequently mentioned in climate disclosure conversations are the Task Force on Climate-related Financial Disclosures (TCFD) and International Sustainability Standards Board (ISSB). How do these fit into the policies outlined above?

These groups provide the frameworks for companies carrying out climate-impact reporting geared towards investors and financial markets.

Many governments proposing legislation mentioned above will require that disclosures follow TCFD or ISSB recommendations. Or, required reporting will be heavily based on one of the two frameworks.

How do ISSB and TCFD relate to each other? TCFD has disbanded as its work is complete. ISSB is now building upon the work of TCFD. Any reporting that fulfills ISSB standards automatically fulfills TCFD.2 Read more about the relationship between TCFD and ISSB here.

Another reporting framework mentioned is the European Sustainability Reporting Standards (ESRS). The ESRS outline how companies subject to the CSRD must fulfill their reporting obligations.

These groups provide the frameworks for companies carrying out climate-impact reporting geared towards investors and financial markets.

Many governments proposing legislation mentioned above will require that disclosures follow TCFD or ISSB recommendations. Or, required reporting will be heavily based on one of the two frameworks.

How do ISSB and TCFD relate to each other? TCFD has disbanded as its work is complete. ISSB is now building upon the work of TCFD. Any reporting that fulfills ISSB standards automatically fulfills TCFD.2 Read more about the relationship between TCFD and ISSB here.

Another reporting framework mentioned is the European Sustainability Reporting Standards (ESRS). The ESRS outline how companies subject to the CSRD must fulfill their reporting obligations.

References

- [Draft] ESRS 1 General requirements. (n.d.). https://www.efrag.org/Assets/Download?assetUrl=%2Fsites%2Fwebpublishing%2FSiteAssets%2FEFRAG%2520PTF-NFRS_MAIN_REPORT.pdf

- IFRS Foundation publishes comparison of IFRS S2 with the TCFD Recommendations. IFRS. (2023, July 24). https://www.ifrs.org/news-and-events/news/2023/07/ifrs-foundation-publishes-comparison-of-ifrs-s2-with-the-tcfd-recommendations/